How to Prepare for the Impending Market Crash

- Adam Schacter

- Dec 4, 2025

- 3 min read

If you haven’t heard by now, there is a market crash coming.

There is an A.I. bubble akin to the tech-wreck crash of pre-2000, consumer debt levels have reached pre-2008 levels, valuations are the highest they have ever been, inflation is too high, interest rates are too low, corporate earnings are too good to be true, geopolitical risk is lurking, and the yield curve has been upside down longer than a gymnast in training.

So, how should one prepare for this inevitable stock market collapse? Easy.

Step 1: Panic.

Step 2: Sell everything.

Step 3: Regret it forever.

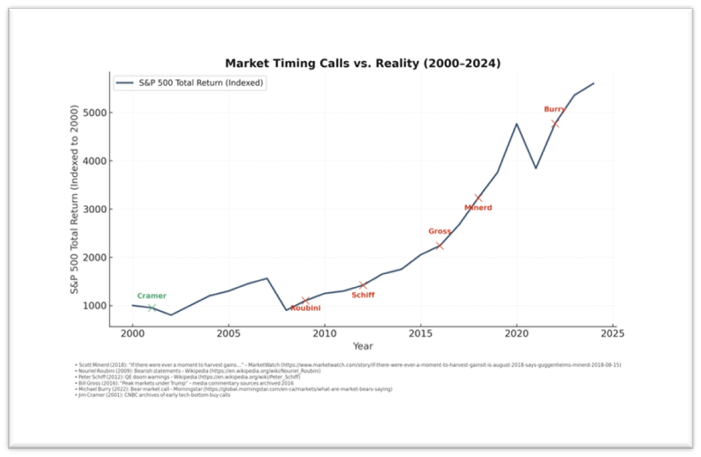

Timing the Market: A Spectator Sport with Terrible Odds

Every year, someone calls the top — and someone else calls the bottom. They both sound convincing, but only one ends up being right, and usually by accident. Remember those who sold in 2008 and waited until 2013 to get back in? Or the investors who sold in March 2020, right before the fastest market recovery in modern history? Remember the notion of Bull Markets lasting a maximum of 8 years, and so 8 years after 2008 (2016) was projected to be the next elongated bear market? Even professional fund managers with armies of analysts, PhDs, and proprietary algorithms routinely underperform by trying to time the market.

The truth is, significant crashes typically catch everyone by surprise.

The Illusion of Control

Market timing gives the comforting illusion of control — that if we just analyze enough charts or read enough economic tea leaves, we can sidestep the pain and catch every rebound. In reality, it’s like trying to jump on a moving train in the dark. Miss just a few of the best days in the market and your returns collapse. Miss the worst days, and you look like a genius — until the next rally leaves you behind.

Even if you got off the train at the right time, you would need to also jump back on at the right time… Not a winning strategy from a statistical probability standpoint.

What We Actually Do About It

At Avesta Wealth, we don’t claim to have additional market insight, nor inside information. We don’t try to outguess the market.

We do something far more productive: we strategically rebalance. When markets rise, we trim market risk. When they fall, we redeploy into opportunity. It’s not market timing — it’s disciplined portfolio management. Think of it as turning down the volume rather than changing the song.

For instance, in December 2024, as markets hit euphoric highs, we dialed back equity exposure (in hindsight, perhaps a little too early). This small but significant shift provided investors with dry powder for future opportunities, while keeping clients fully invested in alignment with their long-term goals.

But the Stock Market is Going to Crash!

Of course, the market will crash again. It always does. Every correction, bear market, and recession feels like the end of the world in real time, and then, looking back, it’s just another bump on the chart. From the Great Depression to the dot-com bubble, to 2008 and 2020, markets have always recovered — often faster than anyone expected.

Stay the Course

The real danger isn’t the crash itself — it is reacting to it. Investors who stay the course, rebalance, and remain disciplined tend to come out ahead of those who try to outsmart the market. The crash will come, and it will go. What matters is how you behave through it.

The Takeaway

You can’t time the market. No one can. But you can have a plan that automatically adapts when markets rise or fall — a strategy built on fact and discipline, rather than insight and prediction.

This is what we do every day: prepare, not predict.

"The four most dangerous words in investing are: 'this time it's different'"

-Sir John Templeton

We continue to monitor our holdings on an almost daily basis to evaluate if the reasons we bought them in the first place remain true today.

Comments